Digital Assets ◇ Real Equity

Institutional-grade access to tokenized private equity, built on Swiss DLT law.

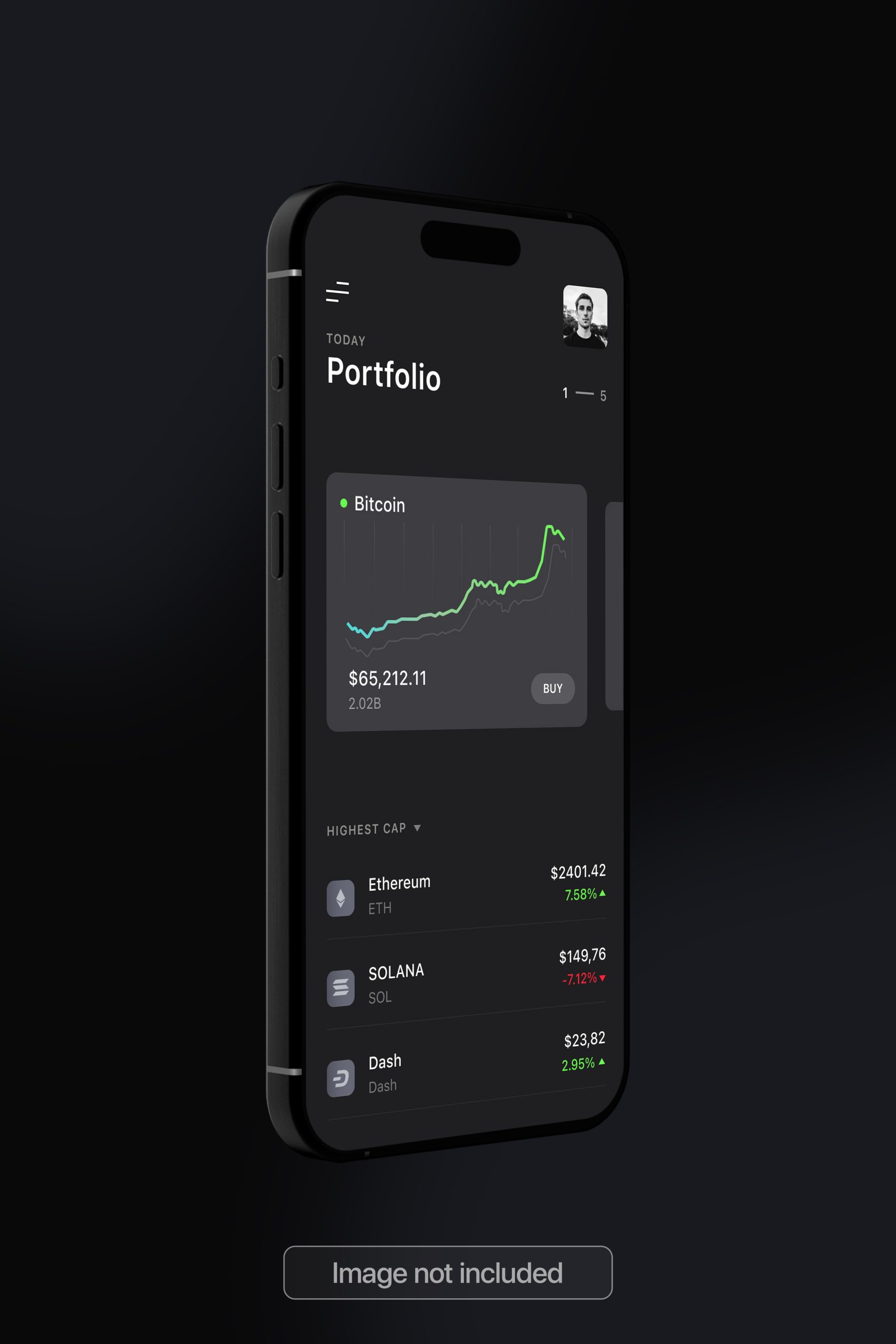

Digital Asset Management

By Our Strategy

☑️ Swiss-compliant tokenized securities

☑️ Private equity, on-chain settlement

☑️ Professional & institutional investors only

Tokenized Private Equity

Swiss Legal Clarity

On-Chain Compliance

Institutional Process

number of prestige

Service for your Development

We provide the best services, ensuring your outstanding growth

Tokenized Private Equity

Swiss Legal Clarity

On-Chain Compliance

Institutional Process

Regulatory Framework

Any Others Service ?

Strategic Digital Assets Management.

Real Equity.

Our Mission.

Our Vision

Exclusive Solutions for Sophisticated Capital

Proven Process for Structuring Your Capital Success

Investor Qualification

Compliance & Wallet Verification

Subscription

Token Issuance

Choose the Solution That’s Right for You

FOUNDATIONAL ACCESS

Ideal for first-time participants or smaller institutional mandates seeking access to verified tokenized securities and advisory support.

INSTITUTIONAL PLUS / MOST POPULAR

For serious investors ready to access private tokenized equity platforms, enhanced compliance services, and managed on-chain settlement with priority execution.

ELITE CAPITAL

Exclusive tier for UHNW individuals, family offices, and institutional capital seeking white-glove service, multi-instrument strategies, and direct regulatory oversight.

Frequently Asked Questions

Who are your typical clients?

What is the process for investor qualification?

What are DLT Securities under Swiss law?

Is there liquidity for tokenized securities?

“

What Our Partners Say?

More than 99% customer satisfaction is our success.

Michael Torres - Principal

Dr. Patricia Okonkwo

Rahman Al-Hassan

Jennifer Park

Let’s Collaborate with Us!

Blaby Leicester United Kingdom LE8 4GR

Call Cooperate: +1234567890